Knowing the meals and entertainment expenses you can and cannot write off for your small-to-mid-sized business can be confusing. Although the rules continue to change and expenses can range anywhere from 100% to 0% deductible, using this deduction can really help you save on your tax return.

As part of the Consolidated Appropriations Act (2021), the deductibility of business meals did change. This temporary rule had food and beverages 100% deductible if purchased from a restaurant in 2021 and 2022.

However, for purchases made from 2023 onward, the rules revert to how they were defined in the Tax Cuts and Jobs Act. This means purchases for business-related meals are back to only 50% deductible.

Entertainment expenses, like sporting events or show tickets, are still non-deductible.

However, team-building activities or a companywide party for employees are deductible.

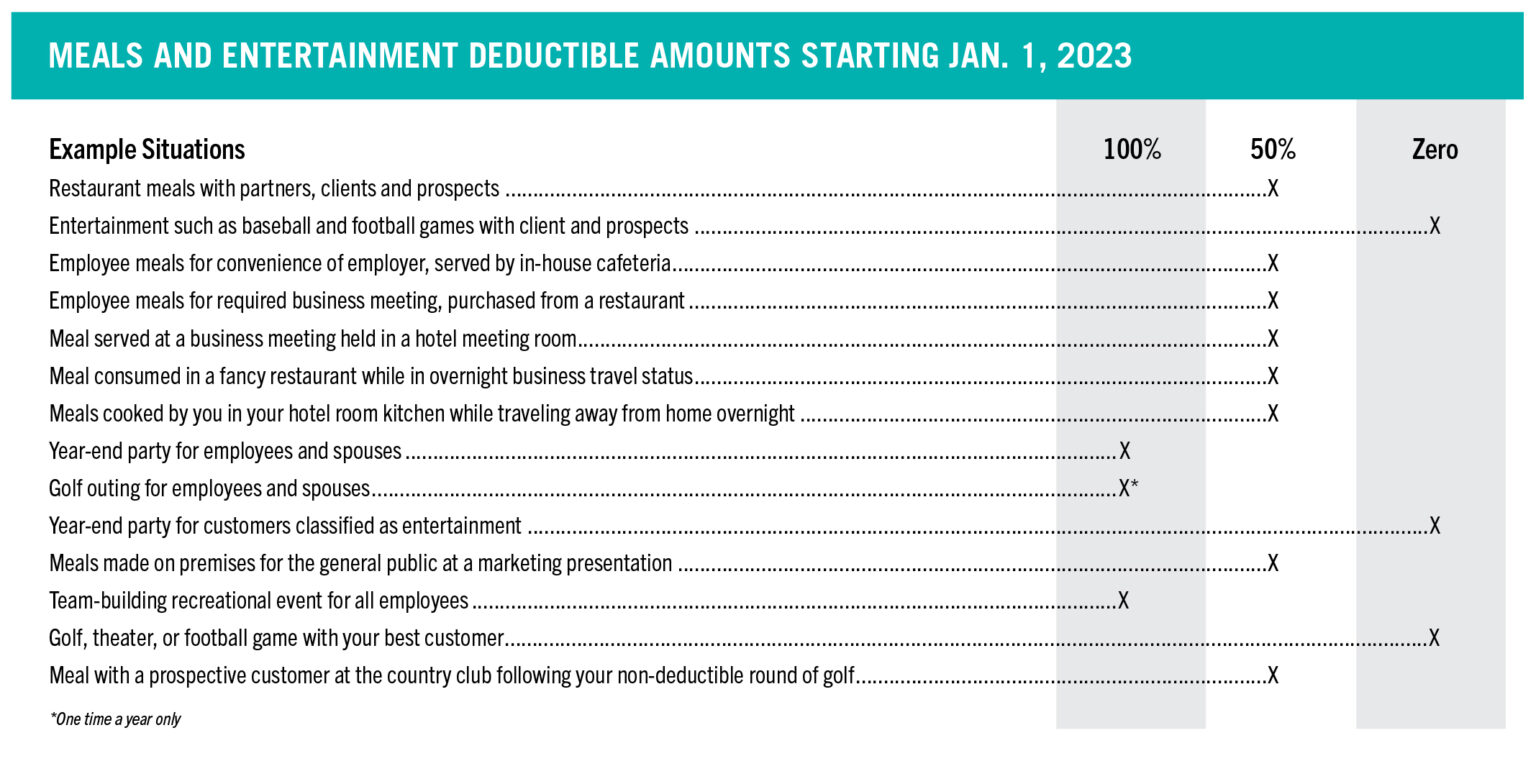

Most of these rules are pretty cut and dry (see examples below). However, there are a few common scenarios that Senior Tax Research Manager Yunnice Chang receives questions about.

“ Team building outings are a great opportunity to take advantage of the 100% deduction ,” said Yunnice . “ This can even include entertainment elements like sporting event ticket purchases or other expenses associated with admission to similar activities .”

The tax code states that “expenses for recreational, social, or similar activities (including facilities therefor) primarily for the benefit of employees” qualify for the 100% deduction.

However, purchasing tickets to take a business client to a sporting event or other entertainment-type events are not deductible. Also gone are charitable deductions for contributions to the right to purchase tickets to a college’s athletic events. You can, however, deduct the meals consumed at these events, if you separate the receipts.

Dinner provided for employees working late is 50% deductible. De minimis fringe benefits like in-office coffee and snacks do not fall into the meal category, however, they are also 50% deductible.

Cruise ship conferences that offer continued education have their own set of rules. Read more about those on our blog .

Check the table below for what you can do in 2024 as the law stands today:

Although your tax preparer may not need a copy of your dinner receipt, the IRS states that you must keep a record of your receipts and document attendee’s names, restaurant’s names, business purposes, and dates in case of an audit.

If you have expenses abnormally higher than last year, this could be an area at risk for exposure to the IRS. Keeping documentation will help support an audit, should it happen. If you cannot substantiate your expenses, you will be required to pay back the tax, penalties and interest.

Reducing your tax burden is essential to reaching long-term financial goals. Our in-house tax professionals play an integral role in helping our clients ensure we’ve exhausted all measures to reduce any tax liabilities. To learn more about how our planning and tax teams can help your practice, schedule a complimentary consultation .

Cain Watters is a Registered Investment Advisor. Cain Watters only conducts business in states where it is properly registered or is excluded from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. Request Form ADV Part 2A for a complete description of Cain Watters investment advisory services. Diversification does not ensure a profit and may not protect against loss in declining markets. Past performance is not an indicator of future results.

LIKE THIS ARTICLE? HERE ARE OTHERS YOU MIGHT LIKE.